Donating collections

Once collectors reach a certain age, most start considering what they should do with their collections when they are ready to give up their hobby. I have corresponded with many collectors, but I know only one whose beneficiaries had interest in their collections. Thankfully, most of my correspondents have been realistic about current collector values. If there were any common theme, it was the pain they felt from parting with their long-time collections.

The allure of donation

Are you absolutely certain you want your collection to end up here? This clip from the final scene of Raiders of the Lost Arc might be an exaggeration in scale, but definitely NOT in access to donated collections.

Correspondents have always discussed donating entire collections to universities, colleges, libraries, museums, and historical societies. The primary question was whether donation made sense? Unless collectors had served on the boards of such organizations, the idea of donating was alluring. Donating to a deserving institution seems like it should be quick, easy, beneficial from a tax perspective and, of course, should leave a legacy. Everyone wins, right?

Not necessarily. Recipient organizations don't always want, need, or deserve certain kinds of donations. Stocks and bonds are rarely on the tops of their lists of desired donations. Moreover, organizations seldom have the flexibility to deal with all kinds of donations.

Recipient organizations should have written mission statements. Their mission statements should outline what they intend to collect and why. Well-run organizations should keep artifacts and documents only when they relate to their missions. In a perfect world, organizations should be able to deaccession and trade anything that is off-topic. After all, it would not make sense for a museum dedicated to cotton production to keep a donated collection of railroad stocks and bonds. Many organizations focus on local affairs, local commerce, and local people. What good would it do them to receive a donation of railroad certificates issued by giant companies that never even had a railroad through town?

The necessity of deaccessioning

Sadly, many organizations have weak mission statements, if any. Many lack deaccessioning policies. Those with policies are often lax in communicating those policies to potential donors. Consequently, many organizations incur debilitating costs and worries trying to preserve, store, secure, organize, and insure donations they neither need nor want.

I suggest prospective donors research their intended institutions thoroughly and dispassionately. Determine whether a donated collection will help an organization tell its story or hamstring that organization with long-term storage costs.

Several would-be donors have asked about placing restrictions on their donated gifts. They most commonly ask whether they should put provisions in their bequests to keep their collections intact. I suggest it is a bad idea to place limits on what can be done with donations. It is far better to ask what donors can do to help recipients the most. I served for a few years on the board of a historical society and have dealt with its problems. I actually recommended one organization not to accept certain gifts because donor restrictions were too limiting.

Donation to promote research may be a myth

While the general public is ignorant of the situation, almost every institution has lost highly valuable objects and documents through theft and mysterious losses. Consequently, many museums and societies have locked down access to collections so stringently that valid research is difficult and sometimes impossible. Some institutions are downright antagonistic to researchers or anyone who wants to see donated collections. I mention this to warn potential donors that donating collections for supposed "research" often ends up benefitting very few. Donating to certain organizations is pretty much the equivalent of throwing away the key.

Tax benefits (?)

Qualifying donations receive Federal tax deductions equal to the current value of donations times their donors’ effective tax rates at the time of filing.

That means that if donors are in the highest income tax bracket (as of 2023), and give collections of certificates worth $10,000 in current appraised value, they would receive tax deductions of $3,700 plus possibly a few percent more from most states. Obviously, donors in lower tax brackets would receive less. Retired collectors who live on pensions and social security might be in very low tax brackets and might consequently reap limited benefits from donations.

With such incredible hits on potential value, I wonder why prospective donors would not contact professional dealers for their offers? Dealers will not necessarily want every collection, but it is certainly worth asking.

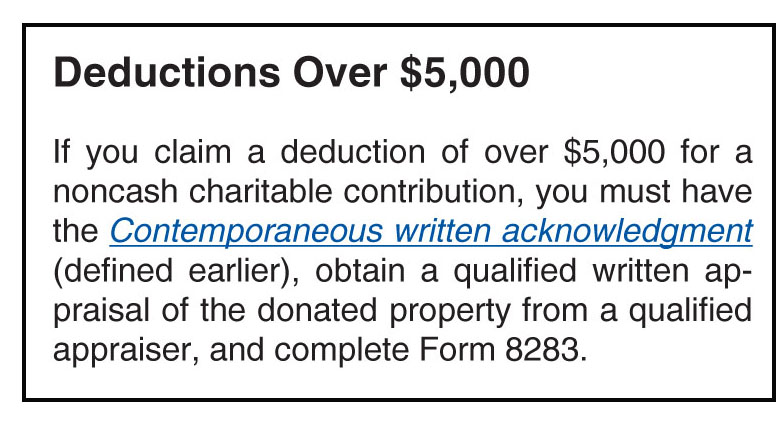

Except from IRS Publication 526

See also Pub. 561 for more thorough details about when appraisals are needed.

The IRS requires that a recent appraisal accompany filings for tax deductions for donations above a certain amount. IRS Publication 561 sets clear rules on the definitions of “current values” of donations and taxpayers must pay for appraisals. Appraisals become a significant issue once donations cross the $5,000 threshold. It is crucial to seek expert tax advice. If appraisals are needed, those appraisals must include supporting valuations. Collectors need to know that It does not matter what they paid for collectibles, nor does it matter when they acquired them. Current appraised values are all that matter. I recommend – in the strongest terms possible – that collectors who are considering donating collections of significant value consult competent tax professionals for advice. (I am talking about "enrolled agents," NOT ordinary tax preparers.)

Yes, yes, I know that collectors might find someone who would appraise donations at double ordinary value and therefore double their tax benefits. The question is not whether higher appraisals are possible. It is how far bending the rules goes before it qualifies as tax fraud. Given how long the IRS has to prosecute tax fraud, not to mentions the penalties incurred, only donors can decide whether pushing the envelope is worth the risk. After all, the IRS knows how to check for values, too.

Negative benefit to the hobby

One final consideration when considering donations of collectibles is the effect on the hobby and all the collectors who will follow. Collectors need to make sure they are donating for the right reasons. All of us – collectors, dealers, catalogers – stand on the shoulders of people who preceded us. Their knowledge and willingness to share helped us get where we are today. So I ask:

- Are donations of certificates going to help the hobby?

- How does it help future collectors to permanently remove scarce and rare certificates from the marketplace?

- Does it benefit anyone (other than the ego of the donor) to lock away collectibles behind the doors of faceless museums?

- How much pleasure would today's collectors enjoy if predecessors had locked away their collectibles?