Cancellation

It is important to know whether certificates have been cancelled or not. Collectors normally pay more for uncancelled certificates than uncancelled ones. Unfortunately, it is sometimes hard to determine whether some certificates have been cancelled. It depends on whom you ask.

Collectors...

... claim that certificates are cancelled when they have been purposely marked as cancelled or when paper has been purposely punched, cut or marked in some manner.

|

Companies...

... claim that certificates are cancelled when company or clearing house records indicate certificates have been legally transferred or bonds have been redeemed (or redeemed to the extent allowed by bankruptcy courts).

|

Potential security value

If you think you might own a certificate with potential security value, then either you or your representative must contact the original company or its successor for confirmation. Company records always prevail when determining security values. Just because certificates show no physical cancellation will NOT matter. Please see Certificates with values as securities to learn more.

The codes used in this catalog are ...

| Abbreviation |

|

Description |

Price |

| iu |

= |

issued and uncancelled |

highest |

| ic |

= |

issued and cancelled |

↓ |

| i |

= |

issued (cancellation unreported) |

↓ |

| uu |

= |

unissued and uncancelled |

↓ |

| uc |

= |

unissued and cancelled |

↓ |

| u |

= |

unissued (cancellation unreported) |

lowest |

Necessary assumptions during cataloging

Assumptions on issuance: Some auctions and some contributors do NOT precisely indicate whether certificates were issued or not. If unaccompanied by images, I assume that new entries will share the same issuance condition as the majority of certificates already cataloged for that variety.

Assumptions on cancellation: Most eBay sellers and some professional auctions do NOT precisely indicate whether certificates are cancelled or not. If images are lacking or of poor quality, I assume that new entries share the same cancellation condition as the majority of certificates already cataloged for that variety. If no previous examples have been cataloged for a new variety, I assume new certificates are cancelled.

The cancellation process for securities

Companies rarely issue paper stocks and bonds today. However, most normal collectible stock certificates and registered bonds followed this process:

- 1) The original owner, or more likely a broker, sold a security to another investor.

- 2) The owner signed the certificate on the back and gave it to the broker for payment.

- 3) The broker sent the certificate to a transfer agent in charge of transferring company certificates. That transfer agent may have worked for a trust company or may have been affiliated with the issuing company.

- 4) The company or transfer agent recorded the transaction in corporate records, cancelled the old certificate in some physical manner, and issued a new certificate to the new owner.

- 5) A company clerk matched the returned certificate with its stub in original books of stocks or bonds. The original certificate was often glued against original stubs with hide glue.

Bearer instruments were negotiable by whomever held certificates. A thief could negotiate a certificate the same as a rightful owner. Obviously, registered securities protected investors than bearer instruments. The process of buying and selling bearer certificates were handled differently:

- The original owner, or more likely a broker, sold the security to another investor.

- The owner received money for the security and handed over the certificate to the broker or new owner.

Conversion from bearer to registered status

Most bearer bonds, especially those issued during and after the 1880s, were convertible into registered bonds at the option of bondholders. If desired, bondholders (or brokers) would contact the issuing or successor company requesting conversion. Upon acceptance, bondholders would send bearer bonds the companies that issued them. Most commonly, companies removed coupons from bearer bonds, marked the back of bonds to indicate the bond was considered registered, and returned them to bondholders. Such bonds are seen occasionally, but they are quite rare.

Recording the transfer of certificates was more important than cancellation

The process of recording security transactions was critically important. Knowing who owned certificates was important, so companies tried to maintain documentary evidence. Of course, fires, floods and disasters have always found ways of destroying corporate records. Physical cancellations were definite ways of preserving evidence of transferences of ownership or retirements of debt.

As important as physical cancellations were, I want to stress that paper cancellation was secondary to record keeping. Companies frequently overlooked cancellation for all sorts of reasons. Sometimes companies were too busy to physically cancel every certificate. Some companies did not cancel any of their certificates. Some companies were simply sloppy and haphazard in their business practices.

How important is it to know whether certificates are cancelled or not?

The higher the prices collectors pay for collectible certificates, the more important is the subject of cancellation. Cancellation is especially important when considering buying autographed certificates. The more valuable the autograph, the more you need to know whether the autograph itself was cancelled.

The differences in prices paid for cancelled and uncancelled certificates was significantly higher in the 1990s than it is today. Price differences have been compressed because of many market forces. As a group, it is clear that eBay buyers care less about cancellation than more experienced collectors.

In general I ascribe premiums for "iu" certificates of 25% to 70% over "ic" examples for those varieties where both conditions are known. Sometimes more. I generally ascribe premium for "uu" certificates over "uc" examples, but not much. Premiums paid on eBay for "iu" certificates are monumentally unpredictable and it is not uncommon to encounter "upside down" pricing (i.e. higher bids for cancelled certificates than uncancelled ones or higher bids for unissued certificates than ones that were issued.)

Methods of cancellation varied widely through time and between companies

Companies cancelled stocks and bonds with the twin ideas of rendering certificates invalid for future financial use while preserving them for possible future corporate uses. Most of the oldest certificates show only one cancellation method while later certificates commonly show clear evidence of handling by two or more people who each added their own distinctive cancellations. I estimate that almost half of all "ic" certificates show multiple methods of cancellation.

It also appears that companies experimented with almost every conceivable method of marking certificates to prevent re-use. The degree of handwriting and multiple markings on some certificates proves some companies were more paranoid about cancellation than others. As a general rule, cancellations on stock certificates are more variable than on bonds. Bonds tend to show less variance because all bonds of a given issue were usually redeemed at one time, and therefore cancelled en masse. Following is a display of some of the most common types cancellations collectors will encounter.

Examples of the most common cancellations found on railroad certificates

|

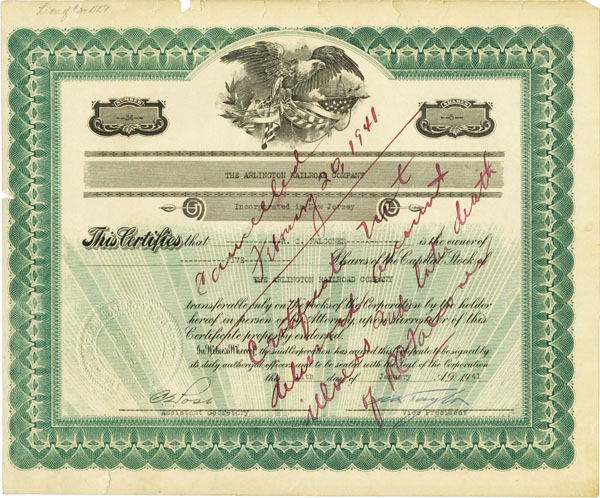

Pen cancellation

The oldest certificates were usually cancelled with ink pens. Black ink was the most common, although red was used occasionally. Certificates were generally cancelled by marking though officers' names and a few companies definitely went overboard in their scribbling. Some companies marked certificates with large 'X's that swept from corner to corner. Companies occasionally went to the extent of writing the word "Cancelled," commonly at angles to the text and sometimes vertically. The cancellation on this example is more elaborate than most and says, "Cancelled February 20, 1941 -- Certificate not delivered account illness and late death of RC Falconer."

|

|

|

|

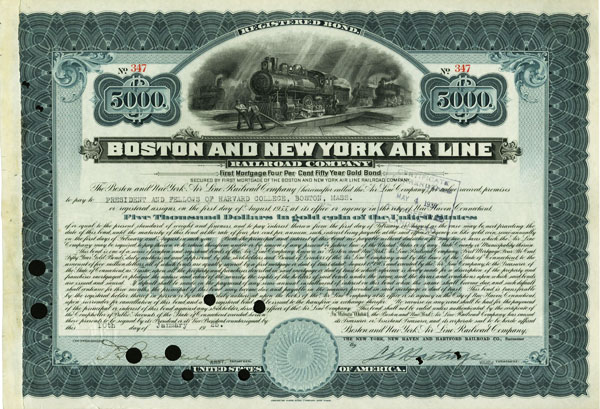

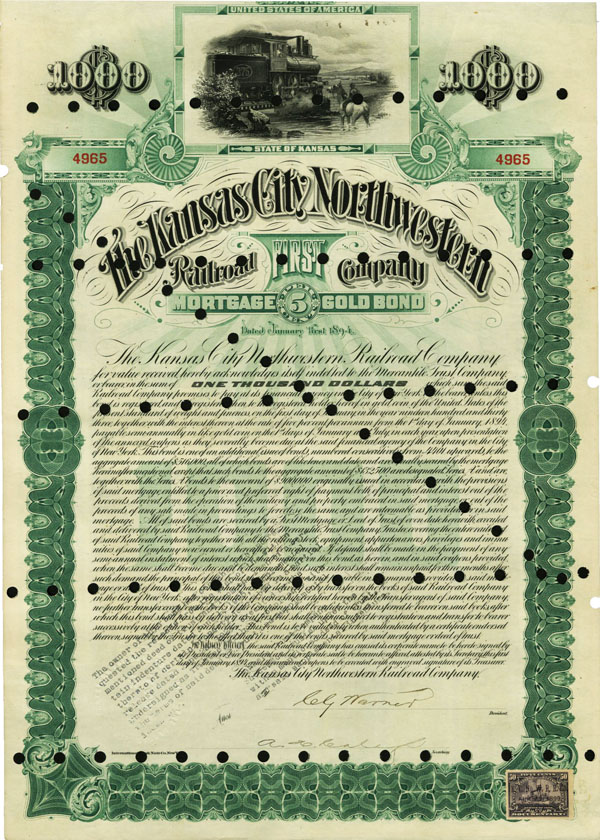

Punch cancellation

The vast majority of certificates are cancelled with hole punches, usually through officer signatures. Punch cancellation were accomplished quickly and created definite proof of paper destruction. Punches could be repaired, of course, so punched certificates generally show multiple holes. Most punches were an eighth to a quarter-inch (2-4 mm) in diameter although some were as large as one inch (25mm.) Holes were occasionally punched through corporate seals, counter signature names, and less frequently through vignettes.

|

|

|

|

;

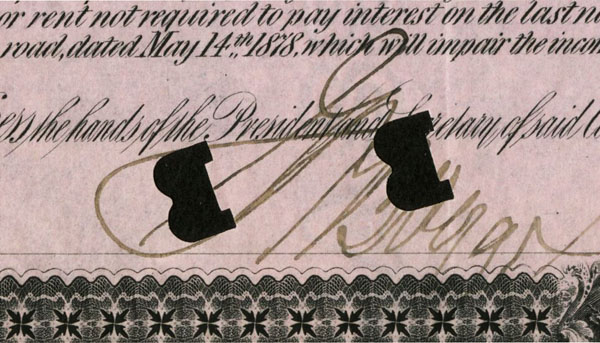

Punch cancellation in the form of letters

Some companies used punches in the shapes of letters. It the letter choices held meanings, they are lost to time. About 10% of certificates show letter-shaped or non-circular punches.

|

|

|

|

Punch cancellation in autographs

Overall, punch cancellations were probably the most popular type of cancellation. In most cases, holes were punched through signatures of company officers. The amounts collectors pay for autographed railroad certificates usually depends on the level of cancellation damage to signatures. At left is an example of Jay Gould's signature found in substantial numbers on 1880 stock certificates of the Missouri Kansas & Texas Railway Co.

|

|

|

|

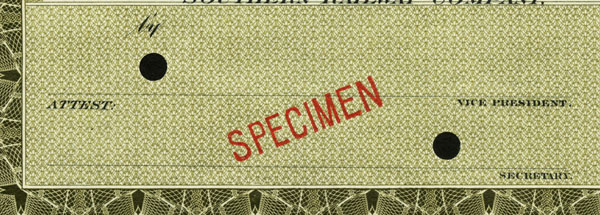

Typical ABNCo specimen cancellation

The majority of surviving collectible railroad specimen certificates were printed by American Bank Note Company. There are no hard and fast rules, but the vast majority of ABNCo specimens are serial numbered "00000" and were cancelled with two small circular punches in officer signature lines and were printed with the word "SPECIMEN." A limited number of "unmarked" specimens lack the distinctive serial number and word "SPECIMEN," but still show the two punch holes.

|

|

|

|

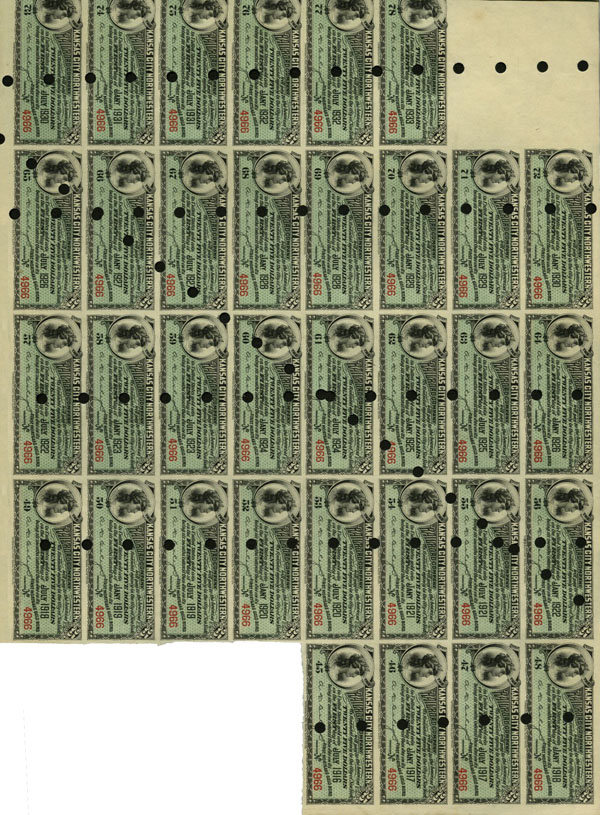

Machine punch (roulette) cancellation

Some companies used "rouletting" machines with wheel-like attachments that punched rows of holes across certificates and these kinds of cancellation are seen most commonly on bonds. It was necessary to cancel hundreds or even thousands of bonds within short periods of time after redemption, so these devices saved substantial labor costs. Clerks usually cancelled both bonds and coupons at once. Six or more passes through the devices might have been needed to cancel bonds and all their coupons. Some sellers describe this type of destruction as "machine gun" or "bullet hole" cancellation.

|

|

|

|

Machine punch (roulette) cancellation

Coupons from the above bond, machine-punched at the same time.

|

|

|

|

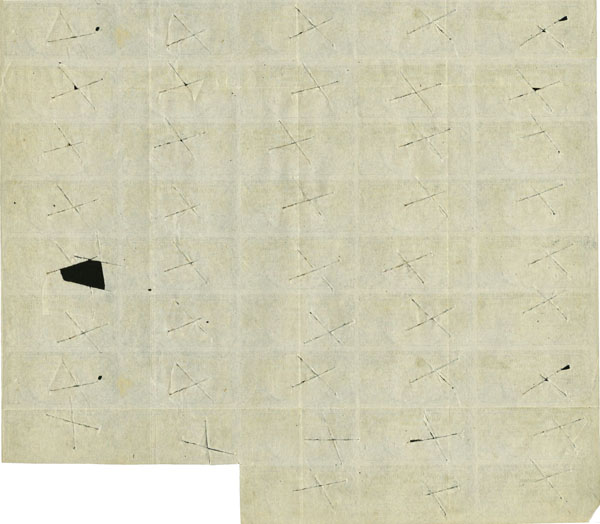

Machine punch (roulette) cancellation

This is an EXTREME case of rouletting cancellation. I count approximately 510 slits, each about a half inch (~14 mm) long spread across almost every square inch of this and similar bonds. All bonds of this series (issued in 1867 by the Montgomery & West Point Rail Road Co) are cancelled in this extreme manner. BEWARE because sellers commonly scan or photograph these bonds in such a way that the cancellations are barely visible. I do not know what drove the company to behavior and I do not know of any other rail-related certificates cancelled to this extent.

|

|

|

|

Hole or punch-out cancellation

Occasionally, punch cancellations removed larger pieces of paper. Sometimes, they were three-quarter-inch circular holes or larger diamond- or rectangular-shaped holes. Many Atchison Topeka & Santa Fe Railroad Co certificates around the turn of the 20th century were cancelled like this.

|

|

|

|

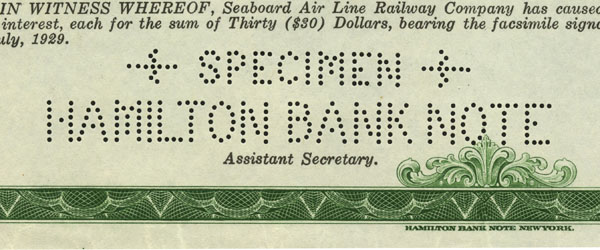

Pinhole cancellation

This form of punch cancellation is made up of a series of tiny holes, usually spelling words or dates. This method of cancellation became very popular after the 1930s. Pinhole cancellations can be problematic for collectors because they are often hard to see in photographs. Because of the location of the punches, this example of a Hamilton Bank Note Company specimen is particularly easy to read.

|

|

|

|

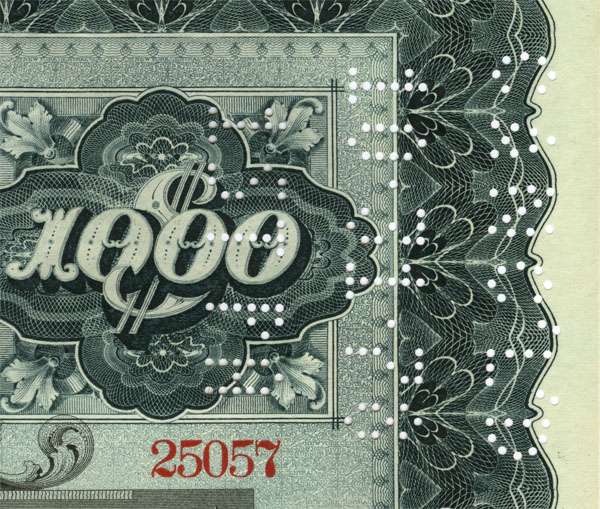

The problem with pinhole cancellations

Pinhole cancellations are easy to see and read when certificates are held up to a light. However, pinhole cancellations can be impossible to see when photographed. Here is an example in the top right corner of a New York Central & Hudson River Railroad Co bond scanned against a white background. There are tens of thousands of these bonds and they appear for sale on eBay constantly. The pinholes on this bond read,

CANC'LD

10•31•78

1ST PA

|

|

|

|

... And here is the same bond

scanned against a black background. Neither white nor black backgrounds make it easy to tell these certificates are cancelled. If photographed with coupons folded underneath, the bonds, the cancellations are almost invisible.

|

|

|

|

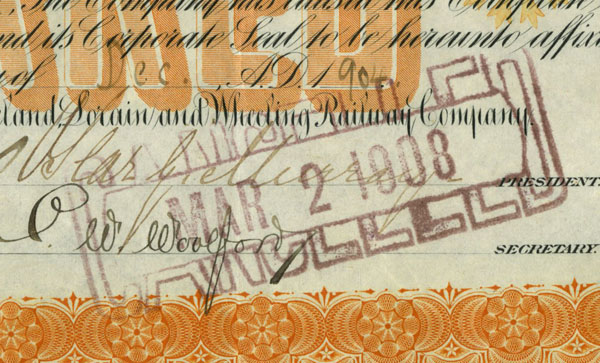

Rubber stamp cancellation

Cancellation by rubber stamps was very common from the 1880s to the 1920s. Rubber stamps usually spelled the words "cancelled" or "void." Red, black and purple inks were most common with blue ink used less infrequently. The majority of certificates that show rubber stamp cancellations also show pen or punch cancellations.

|

|

|

|

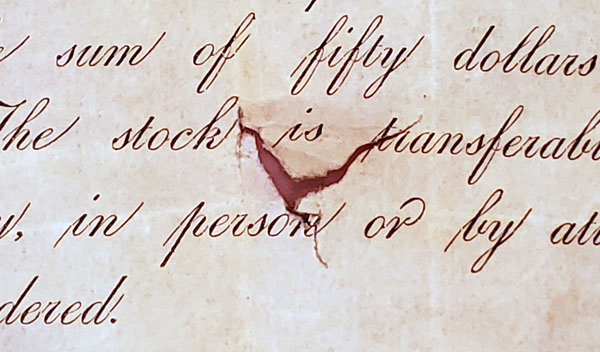

Hammer" or knife cancellation

Certificates were sometimes cancelled with hand-operated devices that roughly resembled staplers. Clerks would place certificates between the jaws of the device and hit the top with their fists or palms. Small knives placed under the top jaw would cut the paper in 'X' or circular patterns. This kind of cancellation is hard or impossible to detect in photographs. Certificates cancelled in this manner are often repaired on the back with all different kinds of tape.

|

|

|

|

Hammer AND knife cancellation

Two different cancellation types are rarely seen used in the exact same spot. It might seem like overkill, but this popular bond from the Blue Ridge Railroad Company bond was both hammer cancelled (circular marks) and knife cancelled (slit through the hammer cancel). Even combined, these cancellations are not particularly noticeable when viewed from arm's length.

|

|

|

|

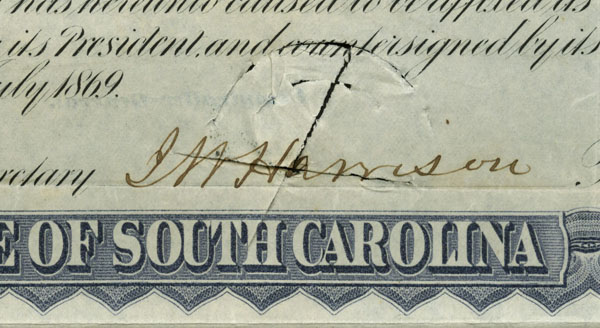

Knife cancellation (cont.)

This is the back of the coupon sheet attached to the Blue Ridge Railroad Co. bond above. The company sold 1,000 of these bonds, all guaranteed by the state of South Carolina. I do not know the number of bonds cancelled in this manner, but this sheet sustained 86 knife cuts in this sheet, shown from the back to make the cuts slightly more visible.

|

|

|

|

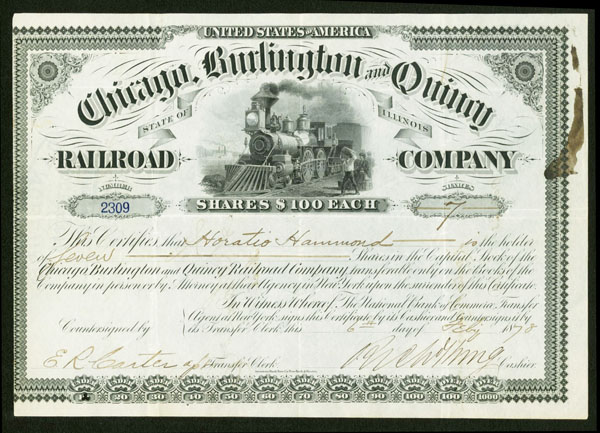

Cut cancellation

Similar, but more radical types of cut cancellations are sometimes seen. Occasionally, certificates were sliced with what appears to have been knives. Cuts can be a couple inches long, but sometimes extend four or more inches in "X" patterns in the centers of certificates. The stock certificate at left from the Chicago Burlington & Quincy Railroad Co was cut by three "V" shaped knives. Cancellations like this can be highly deceptive and invisible in photographs.. (Both images are of the same certificate with the bottom example bent and photographed against black posterboard. Large numbers of certificates from this series were cancelled in a similar manner.)

|

|

|

|

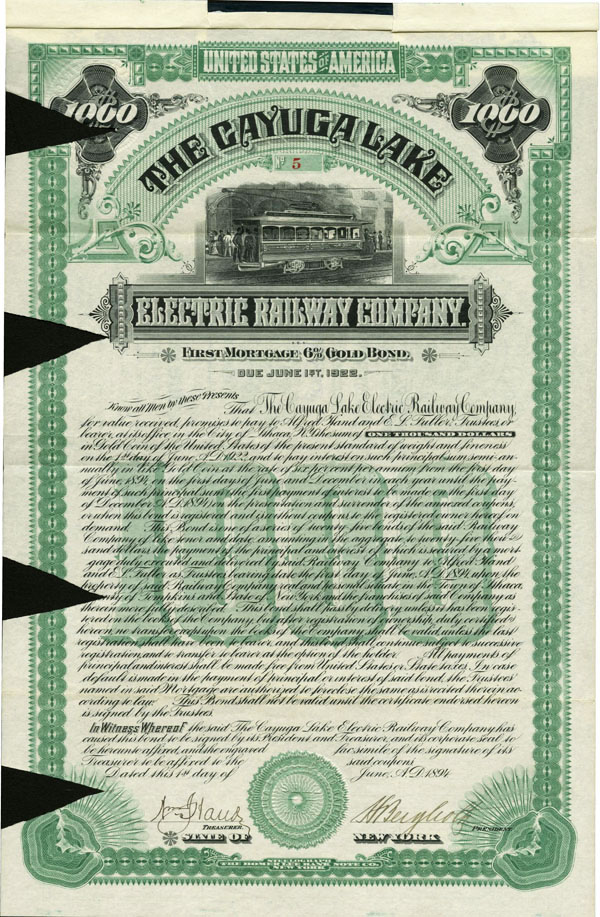

Cut-out cancellation

Punch cancellations can be overlooked in large bonds. A few companies cancelled certificates with large cutouts like shown at left. Triangular cuts are typical, but some certificates are encountered with rectangular cutouts or corners cut off. One could wonder why companies would go to this extent when rubber stamps could have accomplished the same purpose with much less labor.

|

|

|

|

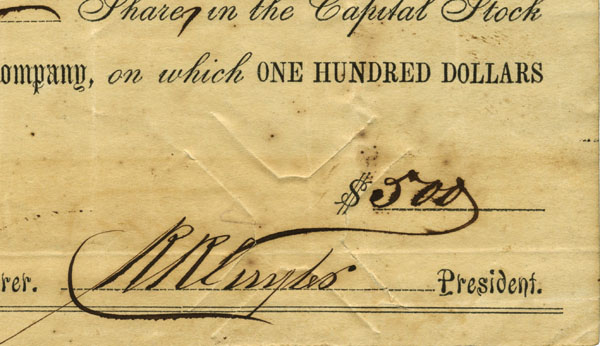

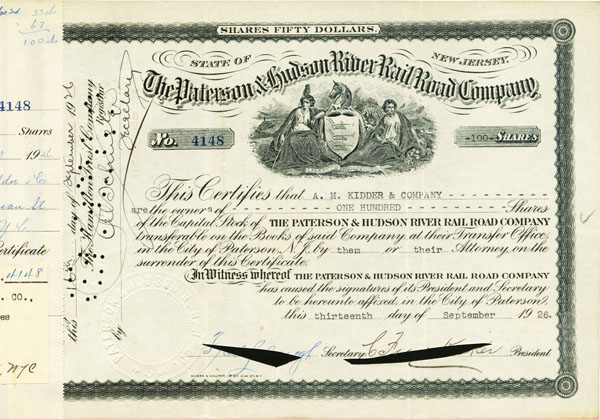

Cut-out cancellation

Occasionally, signatures of one or both officers' signatures were sliced away. Looking at the edges of cuts like shown at left, it appears that razors or very sharp pocket knives must have been used.

|

|

|

|

Spindle cancellation

Stock certificates were sometimes cancelled by impalement on long, thin nails called "spindles." Holes are often only an eighth of an inch in diameter and difficult or impossible to see in photos. This example appears to have been impaled on a larger spindle, perhaps a quarter inch in diameter. Spindle cancellation is not often seen on certificates, but was extremely popular for cancelling checks in banks. (Photographed with a fingertip lifting the edges of the spindle hole.)

|

|

|

|

Spindle cancellation

This is another image of a spindle cancellation, nearly impossible to see in ordinary photos. I have several certificates of this issuance and all show this kind of cut, suggesting the tip of the spindle had three edges that left a triangular cut pattern.

|

|

|

|

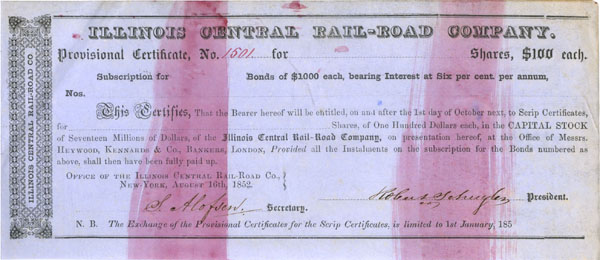

"Rag" or "wipe" cancellation

This is a provisional (or temporary) bond from the Illinois Central Rail-Road Co issued around 1850. All were cancelled with what appears to have been a rag soaked in dilute red ink. I have never seen this type of cancellation on certificates of any other railroad company.

|

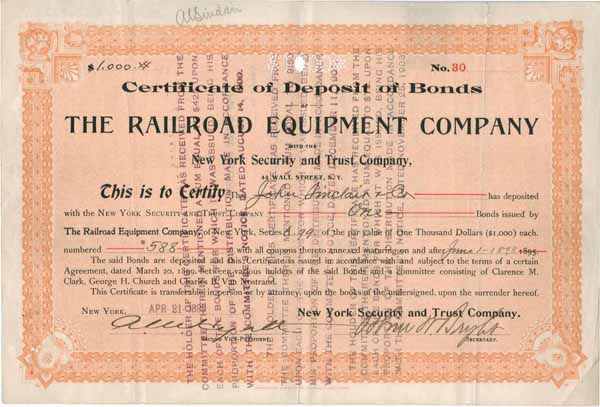

Was this certificate cancelled?

The image of the "Certificate of Deposit" is atypical, but has overprints or rubber stamp impressions similar to many bonds. This certificate shows several rubber stamp impressions and what appears to be a punch cancel at the top.

The leftmost rubber stamp says, "The holder of this certificate has received from the committee therein mentioned a sum equal to $425 upon each of the bonds for which it was issued being his proportion of the distribution made in accordance with the committee's notice dated August 14, 1900."

It appears the Railroad Equipment Company had suffered a bankruptcy some months before and bondholders had formed a committee to try to recover as much of their original investments as possible. We do not know has much interest investors had received prior to this action, but the rubber stamps prove that liquidation of the company under bankruptcy had netted a total of $600 per $1,000 bond by the end of November, 1903.

What about the apparent "punch cancellation." This, too, is not what it first appears.

By scanning against a black background, we can see that the trust company had pinhole-punched the denomination of the single bond represented by the certificate of deposit. What first appears to be a punch hole is really the accidental removal of a zero.

Although typically more verbose, many bonds show rubber stamped or printed text very similar in purpose to the text on the example CD. Such text normally indicates that partial payment had been received for the bond, but there is usually no indication that such bonds were formally cancelled. Collectors should keep this in mind when viewing bonds for sale in the web.

Problematic uncancelled certificates

Collectors occasionally report two kinds of problematic certificates:

- certificates glued to stubs without any evidence of physical cancellation

- certificates that may or may not show signatures on the back with no evidence of cancellation or attachment to stubs

Collectors often question, "Do certificates like this qualify as "cancelled?"

In the first case, practically all collectors would agree that the only way certificates would have been glued to stubs is by:

- certificates returned to companies for official transference

- company re-purchases of their own stock

In either case, the companies would have cancelled certificates in their own records. Companies would have considered such certificates "cancelled" regardless of whether they physically marked certificates or not.

The second case is trickier. While companies always required that certificates be returned to them for legal transference, that was not always done in practice. Investors often signed the backs of their certificates when they sold shares to someone else. One could make the case that transference was not entirely legal. One could also question how investor #2 ever expected to receive dividends if the company had no records of their ownership. There is also the possibility that investors, brokers and possibly company officials traded directly with companies in efforts to avoid additional trading fees. In such cases, the need for cancellation might have been moot.

Whether the second kind of questionable certificate was cancelled or not can be answered only by company records. Regardless of company records, collectors consider certificates lacking physical cancellation marks to be uncancelled. As collectors, they know they are not related in any way to original owners and therefore have no legal claim to the title of certificates as securities or their uncollected dividends. They are completely unconcerned about company records.

Yes, it is true that official records of stock certificate transferal or retirement of debts might exist in corporate records somewhere. Those records are rarely easily available. It might cost hundreds of dollars to locate and research records, if they exist at all. Consequently, collectors must depend upon physical condition alone. If certificates are untouched by physical marks of cancellation, collectors usually consider them uncancelled. If buyers and sellers disagree over that status, disagreement are settled by the amounts of money that change hands and not by courts.