Glossary of bond terms

Accrued income bonds. Bonds that pay interest only when sufficient income has accrued. Companies must make up missed payments.

Adjustment bonds. Bonds issued in exchange for outstanding bonds. Used when re-capitalizing nearly bankrupt companies to adjust interest rates. Companies may delay interest payments.

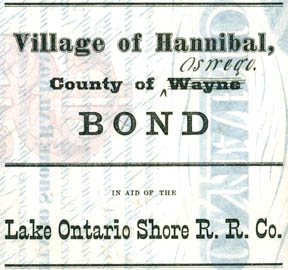

Aid bonds. Bonds issued by public entities (villages, towns, counties, states, and countries) which had the authority to issue bonds. Entities raised funds through the sale of bonds to aid in the construction or operating expenses of private railroad companies in order to secure rail service.

![]()

Annuity bonds. Bonds with no maturity dates. Annuity bonds make steady interest payments. Also known as perpetual bonds.

Bankruptcy. The state of having insufficient income to pay debts. The majority of North American railroads probably went bankrupt at some time in their histories.

Bearer bonds. Bonds that paid principal and interest to certificate holders, who may or may not have been legitimate owners.

Callable bonds. Bonds that companies may "call" or repay prior to scheduled maturity dates. Companies usually pay penalties when buying back these kinds of bonds. Many late-date bonds were of this types and commonly show tables of amounts or percentages to be paid in the event of early calls.

Car Trust bonds. The progenitor to equipment trusts, car trusts played a role very similar to today's automobile leases.

Collateral trust bonds. Bonds secured by financial assets such as stocks and bonds held by trustees. Commonly considered safer investments because securities could be sold more easily than equipment and other railroad assets.

Cognovit note. An extremely rare type of short-term bond among railroad securities that allows creditors (lenders) to obtain judgments against companies without objection in court and without even notifying the debtor company. (Now outlawed in most U.S. states.)

Consolidated bonds or consolidated mortgages. Bonds designed to pay off two or more loans that carry higher interest rates. Railroads often issued consolidated bonds when they merged several lines into larger systems.

Convertible bonds. Bonds exchangeable for stock at pre-established prices. Convertible bonds commonly offer greater potential for value growth if stock prices rise.

Coupon. A small warrant or certificate attached to a bond and redeemable for interest payments. Coupons were usually redeemed twice a year for interest payments in cash.

Coupon or Coupon rate. Financial jargon for a bond's interest rate.. "This bond has a six percent coupon."

Coupon bonds. Bonds issued with coupons attached. Collectible bonds are usually missing some or all coupons. Most coupon bonds are bearer bonds.

Cumulative income bonds. Types of bond that pay interest only when there is sufficient income. Companies must make up missed payments.

Debentures. Unsecured loans, guaranteed only by the reputations of companies. Although debentures are essentially promissory notes, holders of debentures are nonetheless creditors and therefore entitled to pro rata shares of proceeds from bankruptcies in the event of default. The New York Central issued many debentures.

Deferred interest bonds. Bonds that allow companies to defer paying interest, often until maturity.

Divisional mortgage bonds. Bonds issued for the benefit of or paid by specific railroad divisions or branch lines.

Embarrassment. Antiquated financial jargon for bankruptcy.

Equipment trusts. Forms of collateral trust bonds secured by operating equipment such as rolling stock and locomotives. Titles to equipment are normally registered in the names of trusts and held by trustees until fully paid by railroad companies.

Equipment trust certificates. (ETCs) Certificates issued by equipment trusts. Equipment trusts were normally managed by large banks, trust companies, or savings and loans.

Extendable bonds. Bonds that give investors the right to extend the repayment of principal beyond maturity dates.

Extended bonds. Bonds with principal repayments delayed by companies. Collateral normally stays the same. Extension terms are often stamped or overprinted on the faces of the bonds. Some companies issued special "extended debt certificates" instead of stamping original bonds. (This project sometimes records these later certificates among bonds and sometimes among "other" certificates depending on their appearances.)

First mortgage bonds. Primary loans that use company property as collateral. First mortgage bonds are the normally first to be redeemed when companies are dissolved.

Float a loan. Financial jargon meaning to initiate a loan or sell a series of bonds to investors.

Floating-rate bonds. Bonds with variable interest rates. Many recent bonds are of this type. Certificates usually show tables of yearly interest rates.

Funded bonds. Money is accumulated in special accounts so companies can repay loans easily at maturity. Probably synonymous in practice with sinking fund bonds.

General mortgage bonds. Bonds secured by real property (real estate and land.) In the event of foreclosure, bondholders can force a sale of the property or acquire the property at a sheriff's sale. General mortgages commonly cover entire company properties usually already subject to preexisting mortgages.

Gold bonds. Bonds whose interest and principal is promised in gold coinage instead of lawful money.

Guaranteed bonds. Bonds guaranteed by other companies. Holding companies frequently guarantee debts of subsidiaries as do lessees who use other companies' equipment or rights of way.

Income bonds. Bonds that are paid by company income, usually only when there are sufficient earnings. Accrued income bonds and cumulative income bonds repay all missed payments. Non-cumulative income bonds do not.

Improvement bonds. Bonds intended to fund improvements to existing railroad infrastructure.

Interchangeable bonds. Bonds that may switch between bearer and registered status. Coupon bonds from the 1880s and 1890s were generally of this type and occasionally show records of such changes on their backs.

Junior. Financial jargon meaning for obligations are secondary to earlier, senior obligations.

Land grant bonds. Loans that used land granted by Federal or state governments as collateral.

Monster mortgages. Financial jargon for consolidated mortgages that repay several smaller, high interest mortgages in exchange for one larger mortgage with lower interest payments.

Non-cumulative income bonds. Bonds that pay interest only when there is sufficient income. Missed payments are not made up.

Original issue discount bonds. Bonds that carry below-average interest rates. To make up for the low interest rates, companies sell these bonds for less than face values. In other words, companies sell the bonds at discounts to stated face value.

Par or Par value. Financial jargon for a bonds' stated face values (i.e., the principal to be returned at the time of redemption.)

Perpetual bonds. Bonds with no maturity dates. Perpetual bonds make steady interest payments forever. Also called annuity bonds.

Prior lien bonds. Bonds that pay off recorded liens before other mortgages.

Receiver's certificates. Debt issued by court-appointed receivers and trustees in efforts to fund continued operations of bankrupt or nearly-bankrupt, companies. These loans take precedence over all other debt obligations.

Redeemable bonds. Bonds that companies may repay prior to scheduled maturity dates. Companies usually pay interest penalties when repaying bonds prematurely.

Refunding bonds. New loans that replace older ones, commonly at lower interest rates. They work similar to home refinancing to lower monthly payments. Easier to understand as "to fund again".

Registered bonds. Bonds registered to specific owners. Only registered owners, their heirs or their legal assignees can collect interest and principal.

Reorganization. The process of restructuring internal corporate organization or the process of restructuring corporate debt during bankruptcy.

Second mortgage bonds. Bonds secured by loans on company properties already covered by first mortgages. Second mortgages are junior to first mortgages, meaning first mortgages must be redeemed before second mortgages. Second mortgages are riskier than first mortgages and commonly carry higher interest rates.

Senior. Financial jargon meaning financial obligations that must be repaid before others, usually of later issuance dates. "First in time" usually means "first in line" in case of bankruptcy.

Serial bonds. Issuances of bonds that mature (pay off) over time instead of all at once. For instance, If a company sold 1,000 10-year serial bonds, it might pay off 50 bonds every six months. Serial bonds are most useful for borrowing against facilities or equipment that generate consistent income over time. This is particularly the case with equipment trusts that receive consistent payments from companies, thereby allowing repayment of principal to investors more reliably. Almost all equipment trusts in this database were issued with 15-year serial payoffs. In other words, regardless of the amount borrowed, 1/30th of issued certificates were paid off (or "retired") every six months.

Sink a loan. Financial jargon meaning to pay off a loan or to redeem a series of bonds. Opposite of "float a loan."

Sinking fund bonds. Money is regularly set aside in special (interest-earning) accounts so companies can repay loans easily at maturity. Theoretically, sinking fund bonds are relatively safe investments.

Sterling bonds. Bonds repayable in British silver coinage.

Trustee's certificates. Debt issued by court-appointed trustees in efforts to fund continued operations in bankrupt or nearly-bankrupt companies.

Third mortgage bonds. Loans secured by mortgages on company properties already covered by first and second mortgages. Third mortgages are junior to second mortgages, meaning both first and second mortgages must be repaid before third mortgage bonds. Third mortgage bonds are risky and commonly carry higher interest rates than second mortgage bonds. Very few third mortgage bonds are known among collectible railroad bonds.

Zero-coupon bonds. Bonds that pay no interest. In financial jargon, bonds' interest rates are their coupons. By inference, zero coupon means zero interest. In order to make up for not paying interest, companies sell zero-coupon bonds for much less than their face values.

Zeros. Financial jargon for bonds meant to repay principal, but not pay interest. Investors buy zeros at substantial discounts to face values in hopes of redeeming for full face value at maturity.