Most common types of collectible bonds you will encounter

Mortgage bonds and collateral bonds.

Collateral is an important aspect of bonds. When people borrow money from banks in today’s home-buying market, they guarantee repayment by pledging their homes as collateral. If homeowners fail to re-pay loans, lenders can foreclose mortgages, repossess homes, and sell the real estate to try to recover as much of their original loans as possible.

Railroad are homeowners in that they usually offer collateral when they borrow money from investors. They usually guaranteed their repayments with mortgage bonds by using combinations of land, equipment, locomotives, and rolling stock as collateral. When companies fail to repay their bonds, bondholders can foreclose loans and courts can force companies to liquidate their holdings to re-pay investors.

Just like the modern home loan market, railroad companies often raised extra money with second and occasionally third mortgage bonds. More than two-thirds of all currently known bonds are first mortgage bonds. Second mortgage bonds are much less common. Fewer than twenty varieties of third mortgage bonds have been identified in the scripophily market. See more in the section titled Mortgage bonds.

Equipment trust certificates

Equipment trust certificates (ETCs) are really quite separate from bonds although they share many features in common. This project lists ETCs in the bonds category because they look very much like ordinary bonds.

ETCs are always labeled with the names of railroads, but they never include the word "Company" because were NOT issued by railroad companies themselves, but by trust companies, savings and loans, and large commercial banks. Equipment trust certificates strongly resemble vertical format bonds, often with attached coupons. They are commonly denominated in units of $1,000 like most bonds, but are usually labeled as "shares of "$1,000." They may appear in either bearer or registered form. Learn more in a special section on Equipment Trust Certificates on this website..

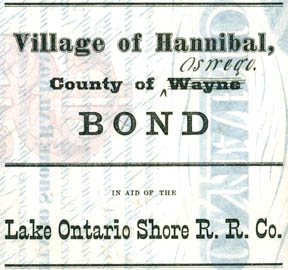

Government aid bonds

This catalog lists well over 300 bonds that were issued by public entities to aid in the building of railroads. While the wording and purposes of these kinds of bonds varied from place to place, the concept was fairly simple. When people wanted and needed rail service extended into remote areas, their towns, cities, townships, counties, and states frequently made deals with railroad companies. Public entities agreed to help pay for railroad building if companies agreed to provide service.

This was generally accomplished through the issuance of specially-designated "aid bonds." See more at Aid bonds.