Other certificates

Stock certificates and bonds account for 90% of all varieties cataloged in this project. Remaining documents are cataloged in a catch-all category of "other" certificates.

By 2024, over 2,500 rail-related items and 100 coal-related items were classified as "Other" certificates. While that number of varieties may seem large, most varieties are quite scarce and represented by very few examples.

Items in the "Other" category are tremendously diverse. Although all are related to stock and bond ownership, some of their original purposes are hard to decipher.

Railroad companies faced a huge array of documentary needs, but the ways companies designed documents to handle problems were seldom identical. Whenever events affected stock and bond ownership and company interactions with investors, companies preserved documentary evidence through the creation of printed forms.

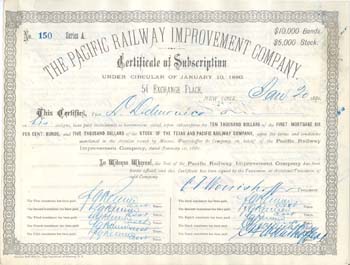

Collectors routinely report new kinds of documents and they always want to know if their document will be cataloged in this project. Because documents are incredibly variable, I cannot give an outright answer without seeing good images. However, the documents cataloged as "Other" share certain characteristics:

- Railroad company names MUST be printed.

- Documents must indicate or represent ownership of stocks or bonds in some manner.

- With rare exception, documents must have been crucial to the ownership of securities. Many had the capability of "standing-in" for securities under specific circumstances. For instance, a transfer indicates the sale of a certificate. If the referenced certificate had been lost in transit, the transfer would have served as conclusive proof of ownership. If effect, a transfer would have served as a "security stand-in" for some period of time. Assessment notices and receipts are also cataloged because they were crucial to the continuing investment in securities. If ignored, ownership would have ceased. Subscription receipts were commitments to buy securities at some future time.

Scrip

Scrip (NOT spelled "script") was usually a form of credit that substituted for cash payments. About half of all certificates in the "other" category are some form of scrip. Railroads tended to issue scrip in order to avoid tapping thin cash reserves. Even though the vast majority of companies promised to pay interest in gold coin or lawful money, they were usually silent about how they would pay dividends. Consequently, it appears many companies issued dividends in the form of scrip. In those cases, scrip was redeemable only in the purchase of more stock. The uses of scrip, however, were greatly more varied than that, so collectors can expect a wide array of documents with intent not always clear. (Click Scrip in the menu at left for more discussion.)

Receipts

If all still existed, railroad and coal company receipts would outnumber and have greater diversity than scrip. Whether cash was coming in or going out, every monetary interaction between companies and their passengers, clients, servicers, and vendors would have required a receipt. Truth be told, the strict definition of receipt is so broad that the majority of certificates listed in this project beyond true stocks and bonds could be called "receipts." This project catalogs any receipt that involved the purchase, sale, or transfer of stocks, bonds, dividends, and assessments. Receipts that don't fall into another sub-category are called "receipts" and constitute the second largest group of "other" certificates. (Click Subscription receipts or Purchase receipts in the menu at left for more discussion.)

Fractional stocks and bonds

Early railroad companies tended to issue scrip to investors whenever incoming or outgoing cash involved amounts less than the dollar equivalent of full shares or full bonds. Later companies tended to formalize similar transactions with dedicated certificates denominated in either partial shares or dollar amounts. Strictly speaking, fractional certificates are really receipts, differing simply by the addition of the word "fractional." Companies intended fractional certificates to be temporary in nature and hoped investors would have redeemed them through the purchase of whole shares or whole bonds. (Click Fractional stocks and bonds in the menu at left for more discussion.)

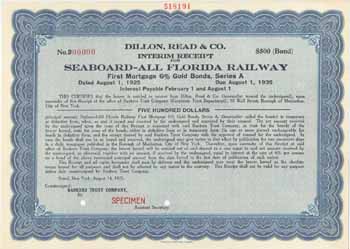

Temporary stocks and bonds

Companies generally issued temporary certificates prior to the printing of formal, vignetted stocks and bonds. While proof is lacking, it appears some companies may have issued temporary bonds to gauge response among investors prior to going through the whole underwriting, promotional, and printing process. Whether true or not, temporary certificates gave companies the ability to abandon issuing securities if an insufficient number of stocks or bonds were sold or if economic conditions changed.

A small number of certificates are labeled as "provisional" and probably filled the same role. Similarly, certificates labeled as "Interim" were intended to be temporary, although some appear to have been issued during the period between bankruptcy of a company and the creation of a new successor. (Click Temporary stocks and bonds in the menu at left for more discussion.)

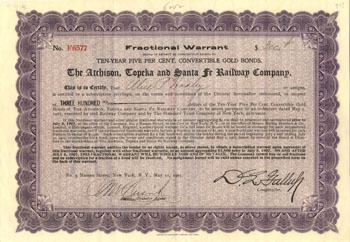

Warrants

Certificates labeled as "warrants" are probably the fifth most common type of "Other" certificates. Their role was to give investors the rights, but NOT the obligations, to purchase shares or bonds at pre-determined prices. (Click Warrants in the menu at left for more discussion.)

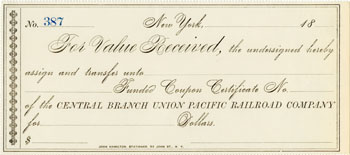

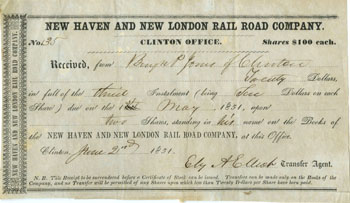

Transfers

Transfer certificates are receipts that testified to the sale of securities from one investor to another. This project catalogs such documents because they had the potential of serving as a security for the buyer in the event something happened during the time it took to deliver stock certificates or bonds to new investors.

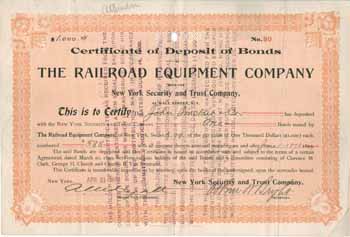

Certificates of deposit

While a few certificates of deposit (CDs) could have been used for both stocks and bonds, most were labeled specifically to type. CDs were normally used during receivership and bankruptcy. Stock certificates were often traded to trustees during trying financial events for special trustee certificates. Possession of official stock certificates gave trustees the ability to represent large blocks or majorities of stockholders when stockholder interests or concessions were needed. In practice, this allowed financial events to proceed dramatically faster than normal.

Bond CDs represent similar deposits of bonds with large banks and savings and loans. It appears that CDs consolidated the representation of the most important creditors (bondholders) during bankruptcy. It allowed large blocks of bondholders to speak with one voice during court proceedings. If corporate history is important to a collector, CDs are excellent examples of the times of transition from one company to another. (Click

Certificates of deposit in the menu at left for more discussion.)

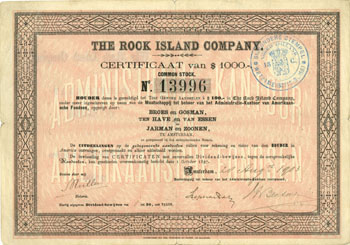

Foreign Investment funds

Many North American companies raised money by selling securities to investors outside the U.S., the largest and most important block being Dutch. From the perspectives of investors outside North America, owners of small numbers of stocks or bonds had no voice in the profitable operation of distant companies. As early as 1856, Dutch brokers began purchasing and managing large blocks of stocks and bonds on behalf of their investors. In effect, brokers created the equivalent of mutual funds that purchased securities from individual companies, as opposed to multiple companies. In those roles, large brokers operated like trustees. They printed their own certificates which they traded to investors, and held the actual securities in escrow. Many Dutch broker certificates traded on the Amsterdam and Rotterdam exchanges.

The vast majority of these broker/fund certificates were issued in the Netherlands, although a handful are known from other European countries. All are cataloged when the appear, although most are sold in Europe and very few make it to North America. (Click

Dutch fund certificates in the menu at left for more discussion.)

Other cataloged certificates and documents

Companies created numerous other documents that dealt directly with the purchase, sale, transfer, and ownership of stocks and bonds. As mentioned above, the original purpose of some of those documents is obscure and may not be understandable without access to corporate records. The key, however, is that all documents cataloged in this project must have a clear relationship to the ownership of stocks and bonds.

Off-topic certificates

Reluctantly, I have cataloged a few off-topic certificates that do not fit the project definition. Some are documents that look deceptively like stocks and bonds and fool even longtime collectors. Some are highly-nuanced documents that take less time to catalog than to explain why they don't belong. Railroad Tax Warrants are among those types of documents. There are a few documents that are utterly mysterious about their original purpose. Thankfully, there are only a few in the "off-topic" category, so very few collectors are likely to stumble across any.

Non-cataloged certificates

This category might seem simple; any document that lacks a clear relationship to the direct ownership of stocks and bonds should be excluded from this project. It is not that I have a bias against any of those documents. I just do not have the time to catalog every possible document that might appear.

My central topics are stocks and bonds issued by or on behalf of North American railroads and coal companies. Everything beyond that is off-topic. That is not an arbitrary decision; there are simply too few hours in a day and too few years in a lifetime. Of necessity, I must exclude all items that are not stock certificates, bonds, or documents that could have served as evidence of ownership of such securities. Obviously, the number of off-topic types of documents

greatly outnumber stocks and bonds and their immediate stand-ins. The most typical types of off-topic rail- and coal-related items that I have excluded include:

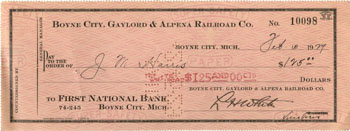

- company checks

- currency and scrip

- invoices

- forms with handwritten railroad or coal company names: There are simply too many such documents. While they may display a hand-written railroad company name, the next, otherwise identical document issued might have displayed the name of a shoe maker.

- powers of attorney: These documents conferred the power to perform some function in place of a security owner. No ownership was ever implied so these kinds of documents are NOT cataloged.

- proxy forms: Similar to powers of attorney, these documents transferred voting power, not securities.

- bond coupons: Although attached to bonds, coupons were meant to be detached and traded for cash; they had no involvement in the purchase, sale, or ownership of securities.

- offers to buy and sell shares: These were advertisements and promotional documents that in no way represented ownership of a security.

- stocks and bonds of non-railroad companies

- stocks and bonds of express companies

- letters to and from companies: None are cataloged, regardless of their topics.

- photographs of rail-related subjects: None are cataloged.

- brochures promoting travel by rail

- maps

- time schedules

- annual passes, 'to and from' passes, complimentary passes, tickets, ticket holders, seat holders

- Pullman passes

- rail-related telegraphs

- baggage receipts

- service awards

- watch accuracy authentications

- railroad Y.M.C.A. passes

I heartily and seriously recommend collectors upset by my narrow-minded focus on stock and bonds from railroads and coal companies to start their own cataloging project. Simply contact me for pointers. When they do, I will begin by offering two overwhelmingly important suggestions:

- Define the boundaries of your project as tightly as you possibly can and KEEP IT TIGHT

- Once you start, DO NOT STOP.