Assessable Stock

Most modern stock certificates are labeled as “fully paid and non-assessable.” That, of course, implies there are assessable stocks.

There are huge stacks of regulations concerning assessable and non-assessable shares, but I doubt that most people understand the differences. In fact, most of the people I talk with are surprised to learn that corporate stock was ever assessable.

Finding relevant history about assessable stock, though, is difficult. It certainly appears from the literature that all early stocks were assessable.

That meant that companies were able to impose levies upon their stockholders for additional funds as they saw fit. Investors would have bought shares in an ordinary manner, but, at any time thereafter, companies could have demanded more money from shareholders. Sometimes, substantially more money.

Assessments were once considered ordinary and expected. For instance, the January 19, 1833 issue of the American Railroad Journal talked about the progress of developing the Boston & Lowell Railroad. “Seven assessments upon the stock have been made, amounting to $300 per share, the amount received from which is $310,050.”

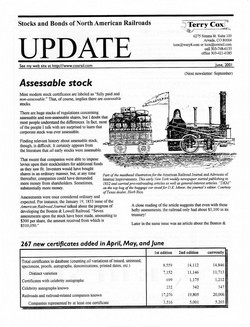

Part of the masthead illustration for the American Railroad Journal and Advocate of Internal Improvements. This early New York weekly newspaper started publishing in 1832 and carried pro-railroading articles as well as general-interest articles. “DKM” on the top bag of the baggage car stood for D.K. Minor, the journal’s editor. Courtesy of Texas dealer, Herb Rice.

Part of the masthead illustration for the American Railroad Journal and Advocate of Internal Improvements. This early New York weekly newspaper started publishing in 1832 and carried pro-railroading articles as well as general-interest articles. “DKM” on the top bag of the baggage car stood for D.K. Minor, the journal’s editor. Courtesy of Texas dealer, Herb Rice.

A close reading of the article suggests that even with these hefty assessments, the railroad only had about $1,100 in its treasury!

Later in the same issue was an article about the Boston & Providence Railroad. It said, “Four assessments have been laid, amounting in the whole to $17 a share; the whole amount received by virtue of these is $63,190.”

It would seem that ordinary investors might have suffered through the small assessments of the B&P Railroad. Assessments from the Boston & Lowell would have hurt.

So far, I have not stumbled across any trustworthy reference that tells when companies switched over to non-assessable stock. It does not take much insight, though, to suggest that assessable stock would have been dangerous for investors to own and hard for companies to sell.

There are many collectible certificates sold as “stock certificates” that are really worded like receipts. Most say that owners had paid the “first installment of ten per cent” on shares priced at $50 or $100 each. I wonder whether those were really efforts to make assessments more palatable by disguising them as “installments?”

I wonder if it truly mattered whether companies called their monetary demands “assessments” or “installments.” It seems unlikely that ordinary investors would have caved into repetitive demands more than a few times.

Even in the case of the seven Boston & Lowell Railroad assessments reported above, we have no way of knowing how many investors actually paid all $300. I cannot imagine all stockholders succumbed to the pressure.

First assessment notice to shareholders in the San Lorenzo Rail Road for $10 per share in 1867. From California Central Coast Railways by Rick Hamman (Pruett Publishing, 1980), courtesy of William Sapara.

First assessment notice to shareholders in the San Lorenzo Rail Road for $10 per share in 1867. From California Central Coast Railways by Rick Hamman (Pruett Publishing, 1980), courtesy of William Sapara.

Furthermore, it seems that investors would have flocked to companies selling non-assessable shares, once a few companies adopted the concept.

When creating my database of certificates, I never even thought about recording whether stock certificates were labeled as “fully paid and non-assessable.” So, I cannot tell with certainty when companies began switching over to non-assessable shares.

It appears that many companies started labeling their shares as “non-assessable” within about a decade of World War I. The earliest non-assessable Union Pacific stock I can find dates from 1927. The Illinois Central sold non-assessable shares as early as 1922 and the Northern Pacific labeled its shares thusly as early as 1911. The B&O’s non-assessable shares go back at least as early as 1902.

The very earliest issuances I can find, however, come from the N&W. Its certificates say that shares were “not subject to future calls or assessments” and are dated as early as 1882.

Unfortunately, my records are incomplete for most railroads. It seems very unlikely to me that the MoPac, Pennsylvania, or New York Central would have waited until the 1940s to switch over to non-assessable ownership. And the Rock Island seems too large a company to have waited until 1947 to issue its first non-assessable share.

But let’s not fool ourselves. In reality, non-assessability depended strictly on companies’ articles of incorporation and how they were amended by boards of directors. Many companies, maybe even the majority, might have switched over to non-assessable stock long before they engraved such provisions on their certificates.

267 New Certificates Added in April, May, and June

|

1st Edition |

2nd Edition |

Currently |

| Number of certificates listed (counting all variants of issued, specimens, etc.) |

8,559 |

14,112 |

14,846 |

| Number of distinct certificates known |

7,152 |

11,146 |

11,713 |

| Number of certificates with celebrity autographs |

699 |

1,175 |

1,212 |

| Number of celebrity autographs known |

232 |

342 |

347 |

| Number of railroads and railroad-related companies known |

17,276 |

19,805 |

20,006 |

| Number of companies for which at least one certificate is known |

3,516 |

5,001 |

5,203 |

.

.

Searchable Database now available on the web!!!

There is still no conclusive word from the publisher about the fate of the second edition. So, to try to fill the gap created by its absence, I have posted the entire database to the web.

Go to www.coxrail.com. Click on the SEARCH DATABASE button. You can search every certificate I know of. The database is updated about once a week.

The web database is not meant to take the place of the hard copy book. After all, a physical copy is far easier to search and browse.

Still, I think you will find the database handy. And I beg you to send copies of any of the certificates I’m missing. Also, please send corrections to any mistakes you find.

How many more certificates are left to find?

We know that the number of varieties of collectible certificates is large, but most assuredly finite. And we suspect that new hoards will occasionally appear. But, over time, we ought to see the number of new discoveries tapering off.

In checking database statistics over the last couple of years, it appears that declines might be starting to appear.

One category that is definitely showing a decline is in the number of new celebrity autographs. I have only added five new names this year. The number of new celebrity names being added has been dropping since December, 1999.

This is partly a result of my decision not to load the database down with autographs of minor personalities. If personalities do not appear in major biographies, I generally do not include them. I am extremely reluctant to imply that autographs of minor and regional celebrities have long-lasting values.

In fact, were it not for very minor celebrities with famous family names like “Vanderbilt,” “Astor,” and “Gould,” the database of celebrity autographs would be even smaller.

Countering the drop-off in new names, though, is a slow but continual expansion in the number of varieties upon which celebrity autographs appear. For instance, in the last year, Jay Gould’s signature has appeared on several certificates that were unlisted in the first edition. This is particularly significant, because his signature on everything but the MKT is scarce to very rare.

1 share from Ferrocarril Michoacano del Sur courtesy John Martin.

1 share from Ferrocarril Michoacano del Sur courtesy John Martin.

We are already halfway through the year, and the numbers of new certificate varieties are currently increasing at a rate of 1,032 additions per year. This is roughly half of the rate of new finds made in calendar year 2000, but almost identical with 1999. Last year saw a huge increase due to your efforts in getting new items into the second edition.

I know there are still many new finds left to add among so-called common certificates. Getting collectors to contribute those certificates, though, is almost impossible. By comparison, it is easy to find the super-rarities. Seems weird, doesn’t it?

And I know there are many varieties of equipment trusts left to add. They trickle in, but I think we have barely scratched the surface.

Within the last year, a few important new certificates have appeared for Caribbean and Central American countries. In general, though, few new certificates outside of the US are appearing.

This partly reflects low collector interest in those countries. But I think it also reflects the low numbers of available certificates. I would love to see a hoards of certificates emerge from the Mexican National Railroad, because I think it would help the hobby expand in those parts of the world.

Even though I think we are starting to see a decline, I am genuinely amazed at the numbers of new certificates still appearing. Contributions continue to roll in from collectors across the US and Europe.

Five years ago, I would have bet that we would have seen a serious decline by this time. Instead, as I mentioned, we are still adding 1,000 new certificates per year! Pretty neat, isn’t it?

LEH-741-B-72c, courtesy William Sapara.

LEH-741-B-72c, courtesy William Sapara.

Here is What I Mean About Needing Copies of "Common" Certificates

One of my major contributors recently sent me copies of several uncatalogued bonds from the Lehigh Valley Railroad Co. Certificates from this company are easy to find, but many varieties had escaped my attention because I did not have sufficient copies.

With this new information, I can begin to unravel the confusing array of colors and interest rates. It was really tough before. I simply could not find details in the various catalogs and lists to understand the differences.

As you can see, we can now perceive a fascinating pattern emerging. According to the text on some of the bonds, though, there should be at least six more varieties of $250 coupon bonds from 1949. Additionally, it looks like there might be additional 1949 registered bonds, maybe a 4.5% 1903 coupon bond, and maybe even some more 1873 bonds. Do you have any?

In fact, do you have any certificates in similar series from other railroads? Either stocks or bonds. Anything that will add light to series of very similar-looking certificates.