Rarity: the Sacred Cow

I can’t tell you how many times I’ve heard collectors say their purchases are valuable because they are rare. I’ve done it myself and sadly still do. We are usually talking about collectibles we just bought. In essence, we are saying our new acquisitions are suddenly worth more because they are finally in the hands of collectors who appreciate rarity.

I will agree that our collectibles are almost certainly rare. I will agree that we are collectors who appreciate rarity. But I seriously question whether values have changed much in the short time since we took possession.

(Please understand, I am not singling out current correspondents. I am talking about conversations with all collectors in all hobbies, including myself, over a period of 45+ years. It doesn’t matter whether we have been talking about certificates, coins, paper money, watches, automobiles, guitars, engravings, postcards or books. Conversations have always been, and remain, amazingly similar.)

1872 stock certificates like this from the Panama Rail Road Co. are always popular. Estimated over 1,000 may exist (Courtesy William Knadler.)

1872 stock certificates like this from the Panama Rail Road Co. are always popular. Estimated over 1,000 may exist (Courtesy William Knadler.)

Numerous factors influence the ebb and flow of prices, including how many or how few examples are known. The problem with gaining a clear understanding of which factor has the greatest effect on price is that no single factor actually affects prices directly.

Once we begin measuring and quantifying collectibles, we learn that many different factors combine in variable and complex ways to create intangible and emotional desires for ownership. We can get intellectual about describing the process, but it is plain old human emotion that drives desire and thereby prices. When sellers promote rarity as some high and mighty feature, they are simply trying to make collectors emotional enough to buy.

Collectors harbor the belief that rarity affects price directly. The belief is enticingly simple. The truth is quite different. The truth is that collecting hobbies would be very strange places if populations of collectibles actually determined prices.

Rarity most assuredly affects desires. No argument there. The question is whether rarity affects desires as much as collectors imagine.

To answer that question, we need to examine price behavior. In many respects, rarity is like the fraudulent oracle working the controls in The Wizard of Oz. We need to look behind the curtain.

37 New certificate varieties since July

|

July

letter |

This

letter |

| Number of certificates listed (counting all variants of issued, specimens, etc.) |

23,869 |

23,878 |

| Number of distinct certificates known |

18,150 |

18,187 |

| Number of certificates with celebrity autographs |

1,733 |

1,746 |

| Number of celebrity autographs known |

349 |

350 |

| Number of railroads and railroad-related companies known |

26,171 |

26,208 |

| Number of companies for which at least one certificate is known |

7,469 |

7,505 |

| Serial numbers records |

95,885 |

96,971 |

Rare equals valuable – So why do collectors think that rare certificates are automatically valuable? I suspect it is because it seems easy to quantify the numbers of collectibles that may exist. Conversely, it seems terribly hard to quantify desirability. Rarity, in theory, stays static. Desirability can change within seconds. Rarity is an independent fact. Desirability is personal, infinitely changeable and fraught with fear and greed.

Once we accept the possibility that intangible emotions determine prices, it becomes readily obvious that many different features affect desirability and desirability affects prices. Understanding this two-step process is like pulling the curtain away. There is no mystery. The more desirable collectibles are, the more collectors will want to own them and the more they will be willing to pay.

What makes certificates desirable? Historical significance. Autographs. Color. Vignettes. Dates. Appearance. Overall composition. Artistic value. Condition. Competition with other collectors. Advertising. And, of course, rarity.

It turns out that when we collectors consider buying certificates, all sorts of features affect our desires for ownership, even down to the attitudes of sellers. For many collectors, our greatest desire is often the quest of acquiring items in our specialties. Features like poor condition and high prices may lower our desires, while rarity and the possibilities for price appreciation combine to counterbalance our fears. Yes, rarity sometimes affects our desires for ownership more than any other feature. But not always.

WHY talk about rarity again? Because I desperately want you to have fun, be smart and succeed at this hobby. While it’s all about fun today, it will be all about money in the future. It will ultimately be about the money you or your heirs will retain at the end of your collecting career. Your final proceeds will depend on how you buy collectibles today. It doesn’t matter whether you buy super-rarities or common junk. The more you understand about rarity, desirability and prices, the better purchases you will make. The less you will be swayed by amateur sellers swearing that something is valuable because it is RARE! If I ever accomplish anything, I want it to be about helping you understand that it does not matter whether collectibles are rare or not! They must be priced right. They must be desirable in the future. They must maintain and preferably gain value.

Rarity and crude oil behave similarly — Because of the emotional complexity, it is hard to find a good analogy that illustrates the relationship between rarity and prices. The best I can come up with right now is the way the price of crude oil affects the price of gasoline.

Everyone seems comfortable with the idea that when the cost of crude oil rises, gasoline prices follow. Understandably, gasoline buyers seem confused when they notice gasoline prices seldom drop at the same rate as crude. In fact, while the prices of gasoline and crude oil rise and fall in the same general direction, hour-to-hour and day-to-day prices actually fluctuate independently. Price fluctuations often seem mysterious and baffling because the relationship between crude and gasoline prices is so complex. Many factors influence the price of gasoline including time of year, pipeline capacity, infrastructure maintenance, refinery shut-downs, and pollution laws. Not to mention commodity trading margins, option expirations, treasury interest rates, the value of the dollar and other currencies, political speeches and storms. Related but different factors affect crude oil prices including production quotas, political threats and terrorist strikes, fear and exuberance.

1869 bond from The Blue Ridge Railroad Co. 167 serial numbers recorded so far, with possibly 1,000 or more in existence.

1869 bond from The Blue Ridge Railroad Co. 167 serial numbers recorded so far, with possibly 1,000 or more in existence.

It seems like the price of crude would affect the retail price of gasoline more than anything else. Sometimes it does. Sometimes, it has little effect at all.

Rarity has a similar indirect effect on the prices of collectibles. Rarity sometimes matters more than anything else and sometimes matters very little.

The sacred cow — Correspondence always follows within hours whenever I talk about the relationship between rarity and prices. It is like I am questioning something sacred. Letters often carry words of agreement. but hidden between the lines are ubiquitous defenses of the age-old myth that “rare” means “valuable.” Correspondents usually argue that rare certificates are undervalued in today’s market and will gain their rightful full value once collectors truly recognize their rarity.

I completely agree that collectors routinely under-appreciate the astounding rarity of the stocks and bonds we collect. I also agree that prices would rise if more collectors would appreciate that rarity. I am just unconvinced those conditions will come to pass very readily.

I like rarity! — Please understand that I like rare collectibles as much as the next collector. The only difference is that I look at rarity as merely one reason that might affect my desire for ownership. I may not buy as many rarities as my correspondents and I definitely spend only tiny amounts compared to them, but I guarantee that I like rarity.

People misinterpret my stance. They think I am saying that rarity is unimportant. Not so! I say rarity IS important. Rarity is sometimes the most important factor affecting my desires for acquisition. Sometimes it doesn’t matter much at all.

Let’s try the what-if approach — Let’s look at how prices would behave if rarity directly affected prices. If rarity cannot closely predict prices, then we must conclude that other factors are at work.

Assuming the collecting of similar items, if rarity is the most important factor affecting prices, we should be able to discern two relationships.

- Items of similar rarity should display similar prices.

- Items with similar prices should be similarly rare.

Collectibles of similar rarity — Finding certificates with similar rarity is terribly difficult because our census of extant certificates is so imperfect. However, if rarity and price are directly related, then all collecting specialties should exhibit the same characteristics. Fortunately, rarity is known with absolute certainty in one collecting hobby: collectible paintings.

Strictly speaking, every authentic original painting is equally rare. No two are the same. All are unique. Yet, every observer in and out of the hobby knows that prices for single paintings range from near zero to tens of millions of dollars.

Still, all original paintings are equally rare.

Observers might suggest different techniques, execution, age, subjects, colors, sizes, media, etc. can explain the wide ranges in prices. If so, then they are clearly saying that equal rarity does not mean equal price.

In the hobby of collectible paintings, factors such as execution, age and style clearly outweigh the effect of rarity. It is absurd to argue that every item should be equally valuable simply because every item is equally rare.

1894 bond from the Southern Railroad Co. There may be as many as 80 examples, but I’ve recorded only 32 serial numbers so far.

1894 bond from the Southern Railroad Co. There may be as many as 80 examples, but I’ve recorded only 32 serial numbers so far.

We see similar forces at work in the hobby of collectible stocks and bonds. Even with very imperfect censuses, we can clearly see that factors such as vignettes, designs, signatures, age, popularity, and even company names can outweigh the effects of rarity. We see it is absurd to argue that certificates of equal rarity should be equally valuable.

Collectibles of similar price — Since it is so easy to disprove the population side of the argument, what happens when we examine items in our hobby that display similar prices? Do they indicate similar rarity?

To examine this question, I chose five items with current retail prices about $75. I wanted certificates that many collectors might consider buying and which are neither super-cheap nor prohibitively expensive.

The first example is the very popular certificate variety from the Panama Rail Road. Three sub-varieties of similar design exist, with and without imprinted revenues, but they usually sell for nearly identical amounts. I personally suspect there are about 1,000 such certificates in existence. I will not argue if someone suggests twice that many.

Next are well-known Reconstruction era bonds from The Blue Ridge Railroad Co. Prices for these certificates have fluctuated between $35 and $125 in the last three years.

Less common, but of similar price are 1894 bonds from the Southern Railway Co. which features three stunning engravings by American Bank Note Co.

The next certificate is the uncommon and strangely-named “Cognovit Note” from The Cleveland & Wheeling Railroad Co, dated 1888. I have never encountered a “cognovit” note or bond from any other North American company.

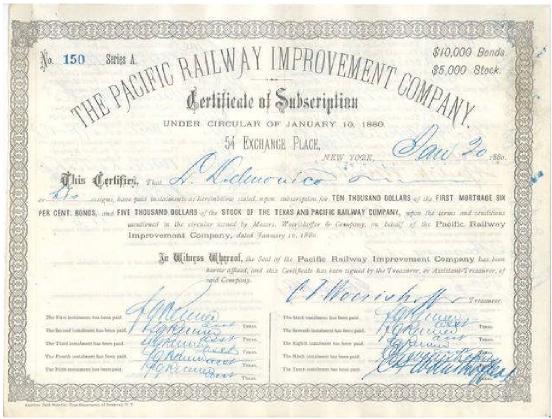

Last is an 1880 subscription receipt from The Pacific Railway Improvement Co., the construction company for the Texas & Pacific Railway. I have recorded only two examples. One sold for $30 to $50; the other example had a J.P. Morgan autograph and sold for $489.

The table above shows the relative rarity of these five certificates.

| Company |

Variety |

Date |

Serials recorded |

Estimated population |

Known sales |

| Panama Rail Road |

S-50a, 50b, 51, 52a, 52b, 53 |

1872 |

300 |

>1,000 |

$6-$344 |

| Blue Ridge Railroad |

B-50, B-52 |

1869 |

167 |

>1,000 |

$6-$315 |

| Southern Railway |

B-35 |

1894 |

32 |

60-80 |

$8-$184 |

| Cleveland & Wheeling Railroad |

B-50 |

1888 |

3 |

<25 |

$35-$55 |

| Pacific Railway Improvement Co |

O-10 |

1880 |

2 |

<20 |

$75-$489 |

| * populations updated to Dec., 2023 |

Overpriced or underpriced? — Based on every sale, contribution and picture I can find, Panama RR certificates greatly outnumber the other four varieties. Looking at potential populations, it appears to me that Panama RR stock certificates may be five times as common as Blue Ridge Railroad bonds and at least fifty times (!) as common as others.

Based on the relative rarity of these five certificate types, collectors could conclude Panama Railroad stocks are highly overpriced. Collectors who appreciate rarity (myself included) could argue the other four are terribly underpriced!

Population is a mystery — We can only guess at the numbers of these certificates that really exist, so we can only guess at genuine rarity. Regardless of actual populations, I feel safe in suggesting huge differences in rarity between the five examples.

Desirability — If rarity between these certificates is so different, then why do they routinely sell for such similar amounts? Comparing prices and rarity, it is obvious that collectors have more desire to own Panama RR stock certificates than the other four. What makes Panama Rail Road certificates so desirable?

(In my opinion, the two varieties of Panama Rail Road certificates with imprinted revenues should fetch higher prices than the plain variety, but actual sales in the last ten years prove otherwise.)

We could spend hours discussing finer points and accuracy of valuations for these five certificates. I personally feel four of the five certificates should be priced two to five times as high. Actual sales prove me wrong. For my money, I will suggest that the Pacific Railway Improvement Co. subscription receipt is the most historic and most scarce, the Southern Railway bond the most attractive, and the Cleveland & Wheeling note the most unusual. Blue Ridge bonds carry autographs of a minor celebrity (Henry Clews) while many Panama Rail Road certificates carry imprinted revenues.

On the minus side, certain factors limit desirability. One item is neither a stock nor bond. Three certificates are rather plain. Curiously, Panama certificates are both the plainest of all and the most common.

Clearly, something affects desire for ownership more than rarity – Prices of collectibles are always determined by how much collectors desire to own them.

The desire for ownership can turn on a dime – It is this near-instant changeability that I think gives collectors the heebie-jeebies and makes them turn to the safety of The Myth that “rare is valuable”.

Let’s say auctions or professional dealers offer us very scarce or rare certificates within our specialties. If we find certificates desirable and priced within our budgets, we will probably buy.

What happens, though, if someone offers us two nearly identical examples? The offers can come at the same time, at adjacent tables in a show or in two different auctions spaced a few weeks apart. How much do our “buy prices” change when offered second certificates? Regardless of how much we are willing to spend for our first certificates, the amount we are willing to pay for second examples is usually much less. Most of us collectors would probably not offer more than 50% to 75% as much for duplicate certificates. Going out on a limb, I suspect that most of us would rather forego purchasing a second example entirely and redirect our money to certificates we don’t own.

Buying to re-sell? – The example above is not an imaginary situation; it happens rather frequently. And some of us collectors are indeed willing to buy second examples “if the price is right.” We often convince ourselves we will improve on the certificates we already own and sell our second examples. When those thoughts enter our minds, we immediately shed our roles as collectors and slip into roles as potential sellers. In those cases, our desires shift from ownership to profit.

“Cognovit Note” from The Cleveland & Wheeling Railroad Co, dated 1888. Three serial numbers recorded; possibly as many as 25 in existence.

“Cognovit Note” from The Cleveland & Wheeling Railroad Co, dated 1888. Three serial numbers recorded; possibly as many as 25 in existence.

Desire for old certificates – Let’s say we desire to own very early certificates for our collections. We jump at the chance to buy examples from the mid-1840s. Then, sometime later, we get chances to purchase examples dated a few years earlier. Whether we decide to buy older certificates or not will depend on any number of factors, including price, budget and condition.

If we do purchase, then how do we feel about the certificates we’re replacing? We may still desire to own them, but I seriously doubt we will desire to own them as much as we did before.

Shifting desires – In these examples, it seems obvious that our desires can change radically and quickly although rarity stays static. When presented with opportunities to own multiple items of similar rarity, our desires always shift to other concerns such as condition, budget, competing collectibles and so forth.

Decreasing desires – Here’s another example that happens to almost all of us, dealers and collectors alike. We find certificates we want and we send our money. When certificates arrive, we occasionally discover problems sellers did not describe. Maybe we find undescribed cancellations, tears or other problems. Maybe we receive certificates different than the ones illustrated. What do we do now?

Some of us will ask for price adjustments and some of us ask for full refunds. Many of us don’t do anything except feel cheated and harbor resentments. But again, the truth is that the assumption of rarity we initially used to justify our purchases never changed. We may have thought we were buying scarce or rare certificates when in fact we were buying something very different. We were not buying rarity so much as purchasing satisfaction.

In this all too common example, price, rarity and desire are intertwined with condition. The relationship is complex. Once we start arguing about price, value and condition, it becomes impossible to ever argue that rarity affects price more than any other feature. Rarity alone does not make something valuable.

The meaning of “rarity” – In most hobbies involving collectibles, the term “rarity“ has two definitions. It can mean a collectible represented by a very low number of examples. It can also mean a relative measurement of probable populations. Depending on the authors of rarity systems, “rarity” can mean different amounts. In most rarity systems, “rarity 1” is the most common, “rarity 2” is more scarce and so forth.

Rarity system for certificates? – For years, collectors have asked me to devise a rarity system for railroad stocks and bonds. They would love to know relative populations. I understand completely.

I have put much thought into the matter and have ask for suggestions from several knowledgeable dealers and authors. I have never implemented a system, though, because we have barely scratched the surface in understanding populations of specific varieties of certificates. Even the five examples used in this newsletter illustrate the huge possibilities for disagreement over how many certificates might exist. In my opinion, publishing rarity estimates at this time would create a system with a near-100% error rate. While I certainly don’t mind being wrong, I think offering a system with a near-100% probability of being wrong seems a little crazy.

What about “availability” instead of “rarity?” – Availability is a very different animal. Unlike rarity, we can readily determine availability by simply measuring how many times per week, year, or decade certificates have appeared. I cannot say exactly how rarity and availability are related. They certainly seem related even though the relationship may not be not one-to-one. Whatever the case, availability is vastly more quantifiable.

1880 subscription receipt for The Pacific Railway Improvement Co. Two serials recorded; possibly as many as 20 survive.

1880 subscription receipt for The Pacific Railway Improvement Co. Two serials recorded; possibly as many as 20 survive.

Availability may, in fact, turn out to be a greatly more important measurement for the hobby than genuine rarity. For instance, a private collection may hold ten thousand examples of an attractive certificate variety, but if that variety only appears about once a year, it may be extremely desirable to collectors. If demand is high and availability low, our desires and prices will be higher than true rarity alone might suggest.

Measuring rarity is hugely important to collectors – At this stage in the development of our hobby, we need dramatically more information about censuses of certificate varieties before we can really measure rarity. Fortunately, this is an area where every collector – beginner, intermediate and expert – can help contribute to the hobby. I don’t know of any other hobby in the world where every participant can materially contribute to the improvement of the hobby.

I have been collecting serial numbers for several years and beg you to contribute your private knowledge. You can help by sending copies or scans of serial-numbered certificates. At one time, I accepted lists of serial numbers. I had to stop because of mis-identifications, the inability to catch new varieties, and the inability to go back and check. Far too many mistakes resulted. (I propose an alternative below.)

If sending scans:

- scan in color

- scan at 200 dpi

- no not use reduction

- turn off auto exposure

- turn off sharpening

- scan entire certificates if possible

- scan in two or three pieces if too large

- scan pieces with 1” overlap

- no need to scan backs

- no need to scan stubs

- no need to scan coupons

- save as medium-quality JPGs

If sending paper copies:

- copy entire certificates

- copy in black and white

- reduce to fit ordinary 81/2 x 11 (or A4) paper

- use white paper

- no need for colored copies

- no need to copy backs

- no need to copy stubs

- no need to copy coupons

- no need to tell me original sizes

- do NOT write on the fronts of copies

I do not care whether your certificates are common or rare. In fact, I have very few serial numbers listed for inexpensive certificates. We need to increase our understanding of all populations and you can help.

You may send CDs, DVDs, or paper copies to my office address below. You may also email images in batches of up to 10 Mb each.

Exception for accumulations and mini-hoards – I greatly need your contributions if you have multiple copies of certificates, especially inexpensive certificates. I recognize that copying or scanning multiple certificates would be an expensive hassle. However, I know you want me to avoid mistakes.

I think a good alternative is to let you send lists of serial numbers of identical certificates and then include copies or scans of the first and last serial numbers. That way, you won’t need to identify varieties. If you first organize your certificates into groups of identical varieties, it will be easy to record serial numbers and then copy or scan certificates with the first and last numbers. By doing that, both you and I have the perfect opportunity to spot previously unrecognized variety changes. You will also help me retain the ability to re-check in case someone in the future finds a new feature that you and I may have missed.

Now the conclusion — If collectors think rarity is always the most important factor affecting values of certificates, they will be constantly mystified by price behavior. If collectors think of rarity as one of many factors affecting desirability, they will see patterns and trends in prices.

That is not to say every single sale price will be either sensible or predictable. Prices for specific single certificates will remain unpredictable because behaviors and motivations of individual collectors will remain unpredictable. Taken as a whole, certificate prices will make more sense when considered from the viewpoint of desirability.

The big bugaboo. Collectors will always focus on rarity – In this newsletter, we saw several examples that proved that rarity is terribly ineffective for predicting values. But that knowledge will not change anything.

At the heart of our hobby lies the unshakeable belief that “rare means valuable.” We can intellectually understand that our desire for ownership establishes value. We can intellectually understand that rarity does not necessarily make something desirable to own. Logically, we can understand the disconnected relationship between rarity and price. Yet, ironically, the very next time we judge price, we revert to our old myth. We can’t seem to help it. Our belief in The Myth seems to be embedded in our very DNA as collectors. The Myth is our sacred cow.